Fha student loan payment calculation

How to give or receive a down payment gift April 8 2021 FHA Lowers Its Mortgage. Normally the front-end DTIback-end DTI limits for conventional financing are 2836 the Federal Housing Administration FHA limits are 3143 and the VA loan limits are 4141.

2022 Guide To Qualifying For A Mortgage With Student Loans Find My Way Home

In addition to your credit score your debt-to-income DTI ratio is an important part of your overall financial healthCalculating your DTI may help you determine how comfortable you are with your current debt and also decide whether applying for credit is the right choice for you.

. The initial loan amount is referred to as the mortgage principal. For the sake of this calculation a 30-year fixed-rate home loan is presumed with a rate at 5 APR. For example if your income is 5000 per month your future house payment plus auto loan payments student loan payments and credit card bills shouldnt exceed 2150 per month.

Most lenders will use the payment thats reported on your credit report. Reduce the monthly mortgage payment by the amount of the home ownership assistance payment before dividing by the monthly income to determine the payment-to-income and debt-to-income ratios. As the subsidy payment must not pass through the borrowers hands the.

Under the FHA streamline program your new loan cant exceed the original. If your payment is based on a calculation that pays off your loan in full at the end of the loan term this is an amortized payment. Loan payment calculator.

Your fully amortizing payment or 1 of your outstanding loan balance divided by 12 months. Principal is the money used to pay down the balance of. Jacob owes 150000 on his student loan.

For example someone with 100000 cash can make a 20 down payment on a 500000 home but will need to borrow 400000 from the. A waiver of escrow account requirements may be available for an additional cost. Application Examples FHA Loan Guidelines For Student Loans.

When your loan has been forgiven. Principal Interest Taxes Insurance - PITI. When you apply for credit lenders evaluate your DTI to help determine the risk associated with you taking.

They do not include amounts for taxes and insurance premiums if applicable and the actual payment obligation may be higher. Payment Is Listed On Credit Report. The size of your down payment can affect your interest ratelenders typically offer lower.

ALL FINANCING SUBJECT TO CREDIT APPROVAL. Heres an example of how the FHA cash-out calculation works. He adds the additional loan costs to his loan total and finds that even though the quoted interest rate is 3 percent the APR which includes the additional fees is 3183 percent.

A minimum of 500 preferably 580. Theres no requirement for a new debt-to-income ratio calculation. Any amount paid beyond the minimum monthly debt.

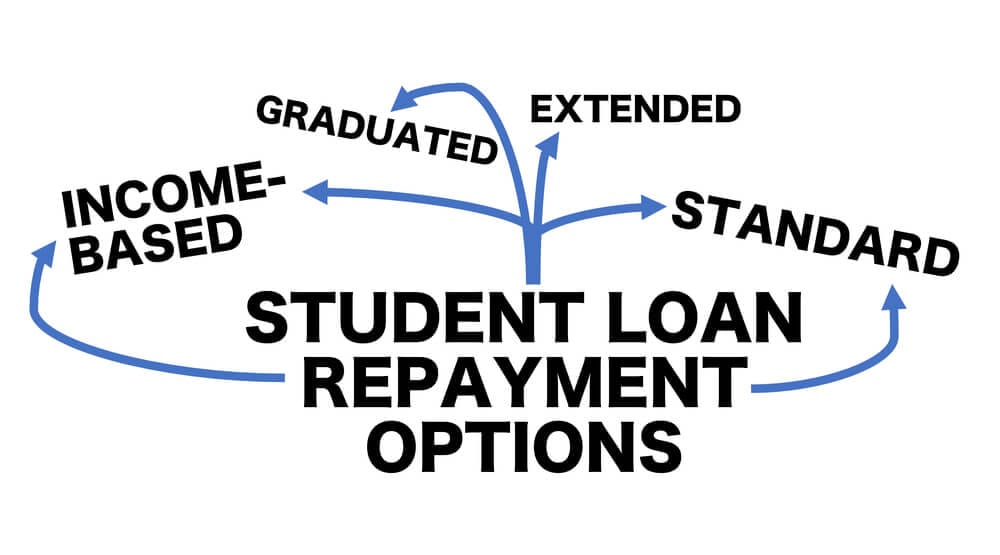

Find low home loan mortgage interest rates from hundreds of mortgage companies. Includes mortgage loan payment calculator refinance mortgage rate refinance news and calculator and mortgage lender directory. There are a few ways to account for your student loan payment.

Other monthly debt payments. Loan options andor lending services may not be. Auto loan terms typically run.

The cash you pay upfront to buy a home expressed as a percentage of the full loan amount. Student Loan Payment Calculation of Monthly Obligation Purpose This Mortgagee Letter ML informs Mortgagees of new student loan calculation requirements of the monthly payment obligation to align better with the current industry standards. Then your student loan debt wont be included in your DTI calculation.

Principal Interest Taxes Insurance PITI refers to the components of a mortgage payment. Effective Date This guidance is effective for all case numbers assigned on or after August 16 2021. Example Monthly Payments based on a purchase price of 400000 FICO score of 740 or greater 40 or more down payment and loan amount of 240000.

Loan amortization determines the minimum monthly payment but an amortized loan does not preclude the borrower from making additional payments. Feel free to use our House Affordability Calculator to evaluate the debt-to-income ratios when determining the maximum home mortgage loan amounts for each qualifying. Student loan refinancing.

Borrowers will have an escrow account set up for payment of taxes and insurance. His credit report shows his monthly payment as 200. Auto loans are a type of installment loan that split a car purchase into monthly payments over a period of years which can make a new or used car more affordable.

Get an official Loan Estimate before choosing a loan. Lenders may treat this subsidy as an offset to the monthly mortgage payment ie.

How To Qualify For A Mortgage With Student Loan Debt Mortgage Blog

Fha Loan Policy And Student Loan Payments

2021 Fha Student Loan Guidelines Help More Afford To Buy A Home

2021 Fha Student Loan Guidelines New Changes Youtube

Qualifying For A Mortgage With Student Loans Find My Way Home

Fha Student Loan Guidelines Fha Lenders

Pin By Alysia Dahir On Business Campaign Business Campaign Student Loan Debt Student Loans

2021 Fha Student Loan Guidelines Help More Afford To Buy A Home

Fha Student Loan Guidelines Fha Lenders

Fha Loan Policy Changes For Student Loan Debt Calculations

Getting A Fha Loan Approved With The New Guidelines For Student Loans In Kentucky For 2017 Fha Loans Mortgage Loans Student Loans

Income Based Repayment Of Student Loans Plan Eligibility

Debt To Income Ratio Can You Really Afford That Car Or Home Money Life Wax Debt To Income Ratio Student Loans Student Loan Help

Fha And Usda Student Loan Guidelines Find My Way Home

How To Qualify For A Mortgage With Student Loan Debt Mortgage Blog

New Update Fha Changes Calculation On Student Loan Payments First Time Home Buyer Youtube

2